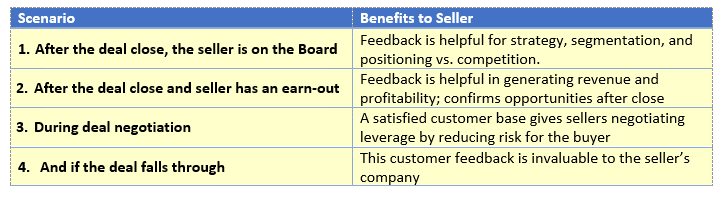

If you are buying a SMB (Small or Midsize Business) and you ask for feedback from the seller’s customer base, you understand it is a reasonable request – but it can be scary for the seller. For example, what happens if a competitor obtains that customer list? Mayfield Consulting, as a third party, has gained this feedback for hundreds of buyers. We capture in-depth feedback from the sellers’ customer base, in the name of the seller. This feedback can be invaluable to the seller, whether the deal goes through or not. Typically, the buyer offering to share the feedback with the seller is the key to gaining their trust to move forward.

Of course, each buyer and the prospective company is different, but over the course of using open-ended questions to gain qualitative and quantitative feedback, Mayfield Consulting found that even though we customize every outreach, the following five topics are asked for repeatedly:

- Customers’ Decision Factors

- Competition

- Switching

- Revenue forecast

- Account Satisfaction and Net Promoter Score (NPS)

- Customers’ Decision Factors

One of the most common topics we use to start our conversation is what decision factors are most important in selecting a vendor / supplier / company like this. Going forward, this helps us know what is important to the customer base, aiding in the development of the “Best Customer” Profile, operational priorities, and differentiation from the competition. In the end, a customer’s decision factors help the company better serve the account and could even save it if it looks at risk.

One of the most common topics we use to start our conversation is what decision factors are most important in selecting a vendor / supplier / company like this. Going forward, this helps us know what is important to the customer base, aiding in the development of the “Best Customer” Profile, operational priorities, and differentiation from the competition. In the end, a customer’s decision factors help the company better serve the account and could even save it if it looks at risk.

- Competition

Everyone always wants to know about competition. Delving into the customer’s perception of where the competition excels and where they fall short supplies a huge advantage to the ongoing business. It can be used for refinements to a company’s strategy, prioritizing segments, and developing positioning and messaging.

- Switching

We always ask about how difficult or easy it is switching to another supplier or taking the work in-house. Always insightful. If, when asked to name other suppliers, the respondents cannot name any, let alone tell you anything about them, it is a positive sign for a buyer. Not knowing the names of other suppliers makes it harder for the account to switch down the road. Our technique allows you to understand the “stickiness” of the customer base.

We always ask about how difficult or easy it is switching to another supplier or taking the work in-house. Always insightful. If, when asked to name other suppliers, the respondents cannot name any, let alone tell you anything about them, it is a positive sign for a buyer. Not knowing the names of other suppliers makes it harder for the account to switch down the road. Our technique allows you to understand the “stickiness” of the customer base.

- Revenue Forecast

Every business needs to plan. Gaining feedback from customers on whether their business with the company will be increasing, decreasing, or staying about the same over the next few years - and why – makes forecasts more realistic. This type of inquiry also aids in gauging the satisfaction of the account.

Every business needs to plan. Gaining feedback from customers on whether their business with the company will be increasing, decreasing, or staying about the same over the next few years - and why – makes forecasts more realistic. This type of inquiry also aids in gauging the satisfaction of the account.

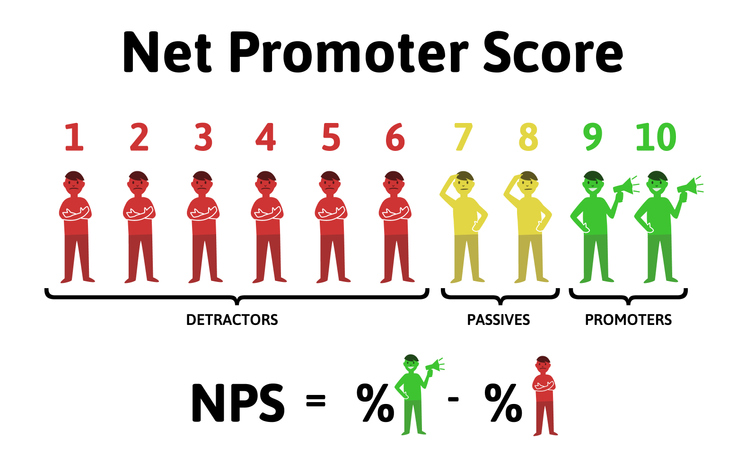

- Account Satisfaction and NPS

Ask any business owner if they want to know how satisfied their customer base is and whether they would refer them to others, and you will get a resounding yes. But finding out the WHY behind that is what helps a company improve. Why are they not satisfied and why did they give a Net Promotor Score of 6 versus a 10, or even a 10 out of 10. It is this qualitative information that will allow a company to save “at-risk “ customers and hone customer service and operations.

Gaining both qualitative and quantitative market feedback provides competitive advantage for any company. Being offered this type of feedback without having to foot the bill can be a huge incentive for a seller. Often just describing these few benefits that come with market feedback can be enough to gain the trust of the seller to hand over a customer list and move forward with the deal. And if the seller will not hand over the list – it is a big red flag.

Gaining both qualitative and quantitative market feedback provides competitive advantage for any company. Being offered this type of feedback without having to foot the bill can be a huge incentive for a seller. Often just describing these few benefits that come with market feedback can be enough to gain the trust of the seller to hand over a customer list and move forward with the deal. And if the seller will not hand over the list – it is a big red flag.